Additional questions to ask financial advisor:

1. What is the highest yield offered on money market-like instruments? (needs to beat CPI after tax)

2. What is the (lowest discounted) fee for equity and income assets for a $1M portfolio?

3. What are your views on MPT?

4. How many accounts are you currently managing?

5. What do you have to offer vs XXX financial institution, or vs XXX group within your institution (some of these institutions are so huge they have multiple groups competing for your assets)?

6. What contacts do you have for tax accountants and lawyers?

Signs that your financial advisor is doing right by you:

1. Recommended a 50-50 split between equity and fixed income for my asset level. Means lower commissions for him.

2. No hedge funds recommended for a $1M portfolio.

3. Showed me his own personal account statements, he was trying to demonstrate that he follows the same strategies himself for all of his assets (he has a decent chunk of change for his age).

4. Pretty straighforward about fees, showed me the entire proprietary fee schedule, including discounts. Broke down how fees are paid to money managers, wirehouse, and broker.

5. Sent me some free research reports and reading materials which I learned from.

Saturday, October 14, 2006

Wealth Allocation Framework Part III

I haven't documented my networth since my May posting. So here's a quick update:

This simple little chart actually took a while to generate, because there is too much going on between the lines. I'm happy to be reorganizing my finances, because it just shouldn't be that complicated.

Some things going on between the lines:

1) Company stock shows $3M from May to Oct, which suggests I had no gains. But I actually sold off at least $300K worth of stock.

2) I paid out estimated taxes of almost $100K.

3) Some munis matured and I allocated the proceeds to a currency hedge.

4) I'm capturing only the big picture with rounded guestimates, there are actually multiple accounts behind various entries (need to simplify more, some accounts were mandated by my company's transactions over the years).

5) I haven't included cash flow being generated by investments (too much work).

6) Like everyone else, I got hit hard in May/June by the worldwide market correction, but bounced back strongly the last few months.

I'm going to put Quicken to work one of these days and get this 8-headed beast under control.

Big picture, for now I'd like to allocate to the Wealth Allocation Framework categories as follows.

Personal assets: ~$2M worth of CD's, munis, cash, treasuries, etc + $900K primary house

Market assets: ~$1.5M worth of managed accounts, mutual funds, etc + $300K second home.

Aspirational assets: ~$2.7M worth of company stock, high yield REI, private equity, etc.

When/if my assets grow another $1M, I'd split the $1M evenly between market and aspirational assets.

As I wrote in my last post, an adequate level for personal assets would vary from person to person, and even for a person as they pass through various stages of life. After spending the majority of my career dedicated to the success of my company, and watching my potential gains roller coaster between $0M and $40M, it would suck to lose it all. But I feel with $2M of safe assets and a house that's paid off, I will be able to sleep at night no matter what happens in the worldwide equity or real estate markets. I would have enough to handle one serious emergency. I would always have a place to call home. I could walk away from my job, satisfied with no regrets. Or I could watch my company lose its competitive edge or its relevance with determination but not despair. I expect these assets to grow at CPI+% after-tax. CPI is running at 3.8% for 2006, this is pretty tough to keep up with for high income tax bracket. CPI briefly spiked to 4.75% after Katrina (maybe that's why CD interest rates shot up for a short time and then came back down). It was as low as 1% during the worst part of the mini-recession in '00-'02.

For market assets, I'd like to hand half over to a professional money manager while I continue to manage half by myself. The bonds in my personal assets category will be held by the money manager to reduce his fees (fees get lower and lower as assets under management get higher, ideally I should keep at least $1M with the money manager). I will transfer more control over to the money manager as I gain confidence in him. I expect market assets to grow at 6-10% on the average.

For aspirational assets, I will always retain a large chunk of my company stock. I have kicked myself in the past for selling too early and missing out on huge potential gains. So I want to retain a substantial amount of exposure to my company performance. I expect these assets to grow at 8-sky's the limit%. Currently, my yield on the real estate investments range from 14-30% APR, and yield on my company stock is I-don't-want-to-think-about-it high.

As I mentioned, I had been moving towards the Wealth Allocation Framework without even knowing about it. So I'm actually not that far off from my target asset allocation. Currently, I'm at:

$1.637 M personal assets + $900K primary home

$1.260 M market assets + $300K second home

$3.265 M aspirational assets

To meet my asset allocation goals, I should sell off more company stock, and move the proceeds to the personal and market asset categories. If I had done this asset allocation earlier, I may not have made the real estate investments, since I want to retain heavy exposure to my company performance. I would also have saved on the taxes on those gains. I'm not sure that my asset level is high enough that I need to diversify into REI (since I'm not that familiar with it), maybe if I had another million or two of play money.

I find this last observation interesting, because I suspect a number of my fellow real estate investors have probably put most if not all their assets into this single asset category. Even though the deals we invested in are both commercial and residential, and diversified geographically, I would still consider them risky with high returns, which would make them aspirational assets.

In the future, I see all three asset categories growing at or above inflation rate. The base allocation for my personal assets will grow when I buy a bigger house, or start a family. The market assets will grow with equity appreciation; I may also add to these assets if my company's growth slows. The aspirational asset category should experience the most growth over the years, and eventually most gains will be allocated to this category.

After working through this asset allocation, my financial game plan is clear:

1. Decide on a money manager for half of my assets in the market class.

2. Sell a little more company stock and transfer proceeds to personal and market assets.

3. Put the rest of the cash in my personal assets category to work, with safe yields higher than CPI. I already have $350K in CDs yielding 5.46-6.45% (I didn't realize the rates would come down so fast, or I would have poured more assets in). I have $437K in tax-free munis yielding 3+%. The rest of my parked cash is earning 4.8% or lower. Merrill currently offers an effective yield of 5.8% on money market-like instruments. If I go with Merrill, I'd park my cash in these instruments.

This simple little chart actually took a while to generate, because there is too much going on between the lines. I'm happy to be reorganizing my finances, because it just shouldn't be that complicated.

Some things going on between the lines:

1) Company stock shows $3M from May to Oct, which suggests I had no gains. But I actually sold off at least $300K worth of stock.

2) I paid out estimated taxes of almost $100K.

3) Some munis matured and I allocated the proceeds to a currency hedge.

4) I'm capturing only the big picture with rounded guestimates, there are actually multiple accounts behind various entries (need to simplify more, some accounts were mandated by my company's transactions over the years).

5) I haven't included cash flow being generated by investments (too much work).

6) Like everyone else, I got hit hard in May/June by the worldwide market correction, but bounced back strongly the last few months.

I'm going to put Quicken to work one of these days and get this 8-headed beast under control.

Big picture, for now I'd like to allocate to the Wealth Allocation Framework categories as follows.

Personal assets: ~$2M worth of CD's, munis, cash, treasuries, etc + $900K primary house

Market assets: ~$1.5M worth of managed accounts, mutual funds, etc + $300K second home.

Aspirational assets: ~$2.7M worth of company stock, high yield REI, private equity, etc.

When/if my assets grow another $1M, I'd split the $1M evenly between market and aspirational assets.

As I wrote in my last post, an adequate level for personal assets would vary from person to person, and even for a person as they pass through various stages of life. After spending the majority of my career dedicated to the success of my company, and watching my potential gains roller coaster between $0M and $40M, it would suck to lose it all. But I feel with $2M of safe assets and a house that's paid off, I will be able to sleep at night no matter what happens in the worldwide equity or real estate markets. I would have enough to handle one serious emergency. I would always have a place to call home. I could walk away from my job, satisfied with no regrets. Or I could watch my company lose its competitive edge or its relevance with determination but not despair. I expect these assets to grow at CPI+% after-tax. CPI is running at 3.8% for 2006, this is pretty tough to keep up with for high income tax bracket. CPI briefly spiked to 4.75% after Katrina (maybe that's why CD interest rates shot up for a short time and then came back down). It was as low as 1% during the worst part of the mini-recession in '00-'02.

For market assets, I'd like to hand half over to a professional money manager while I continue to manage half by myself. The bonds in my personal assets category will be held by the money manager to reduce his fees (fees get lower and lower as assets under management get higher, ideally I should keep at least $1M with the money manager). I will transfer more control over to the money manager as I gain confidence in him. I expect market assets to grow at 6-10% on the average.

For aspirational assets, I will always retain a large chunk of my company stock. I have kicked myself in the past for selling too early and missing out on huge potential gains. So I want to retain a substantial amount of exposure to my company performance. I expect these assets to grow at 8-sky's the limit%. Currently, my yield on the real estate investments range from 14-30% APR, and yield on my company stock is I-don't-want-to-think-about-it high.

As I mentioned, I had been moving towards the Wealth Allocation Framework without even knowing about it. So I'm actually not that far off from my target asset allocation. Currently, I'm at:

$1.637 M personal assets + $900K primary home

$1.260 M market assets + $300K second home

$3.265 M aspirational assets

To meet my asset allocation goals, I should sell off more company stock, and move the proceeds to the personal and market asset categories. If I had done this asset allocation earlier, I may not have made the real estate investments, since I want to retain heavy exposure to my company performance. I would also have saved on the taxes on those gains. I'm not sure that my asset level is high enough that I need to diversify into REI (since I'm not that familiar with it), maybe if I had another million or two of play money.

I find this last observation interesting, because I suspect a number of my fellow real estate investors have probably put most if not all their assets into this single asset category. Even though the deals we invested in are both commercial and residential, and diversified geographically, I would still consider them risky with high returns, which would make them aspirational assets.

In the future, I see all three asset categories growing at or above inflation rate. The base allocation for my personal assets will grow when I buy a bigger house, or start a family. The market assets will grow with equity appreciation; I may also add to these assets if my company's growth slows. The aspirational asset category should experience the most growth over the years, and eventually most gains will be allocated to this category.

After working through this asset allocation, my financial game plan is clear:

1. Decide on a money manager for half of my assets in the market class.

2. Sell a little more company stock and transfer proceeds to personal and market assets.

3. Put the rest of the cash in my personal assets category to work, with safe yields higher than CPI. I already have $350K in CDs yielding 5.46-6.45% (I didn't realize the rates would come down so fast, or I would have poured more assets in). I have $437K in tax-free munis yielding 3+%. The rest of my parked cash is earning 4.8% or lower. Merrill currently offers an effective yield of 5.8% on money market-like instruments. If I go with Merrill, I'd park my cash in these instruments.

Wealth Allocation Framework Defined Part II

I'll briefly go over the basic concepts of the Wealth Allocation Framework, and refer you to Ashvin Chhabra's "Beyond Markowitz: A Comprehensive Wealth Allocation Framework for Individual Investors" for details.

The reason the Wealth Allocation Framework appeals to me is because while reading the article, I realized that I had already started implementing this framework. The article formalized the allocation strategy I've been working on the last few months. The strategy is easy to understand and intuitive, so it makes perfect sense to me.

The problem with Modern Portfolio Theory is that at times the portfolio can still be too volatile (depending on the timeframe that performance is being measured at), and it does not consider my personal life and goals. The main reasons I would be disinclined to solely follow MPT are:

1. In serious bear markets, the stock allocation would make me uncomfortable. I'd have a difficult time watching my portfolio drop 25-50%, and would be tempted to take trading positions.

2. In a strong bull market, I'd be kicking myself for not having a more concentrated position in winners, which would greatly outperform the general market (this outperformance is one way of aspiring to move up in wealth percentile).

The Wealth Allocation Framework addresses these main issues. The strategy recommends allocating my assets into three categories: personal, market, and aspirational assets.

The personal assets are ones that I do not want to jeopardize under any circumstances. These assets are my protection for maintaining my standard of living. Even if all world stock markets and all real estate valuations go to zero, these assets would remain mostly intact. The appropriate level for personal assets would vary from household to household, and even for a single household over time. At my stage, personal assets include the roof over my head, and a comfortable level of stable investments in CDs, treasuries, munis, cash. Later, they may include life insurance, annuities, etc. Just beating inflation is a good goal for these assets.

The market assets allow me to keep up with the Joneses. These diversified assets should perform at the level of the general market. They would include mutual funds, managed funds, some bonds, small individual stock holdings, unleveraged rental property, small amounts of alternative investments for the purpose of diversification, small businesses, etc. These assets can be allocated according to Modern Portfolio Theory.

Finally, the aspirational assets are my longshot investments. If they succeed, my wealth percentile improves. If they fail, my lifestyle is not affected, and my risk is limited. This is money I can accept losing. These assets include leveraged real estate investments, private equity deals, risky business ventures, lottery tickets, a healthy dose of my company stock options, etc.

Over time, as one's wealth increases, the ratios of these assets would evolve. I may decide to move into a bigger home, thus increasing my allocation into personal assets. Eventually, I may decide that I have more than I'll ever need in my personal assets, and start allocating gains only into aspirational assets (this is what most rich people do, which is why the rich keep getting richer).

Judging from family, friends, and PF blogs, I feel that many people are financially lopsided, i.e. they are either too conservative or too aggressive. They either hold too much cash from apathy or fear, or they take on too much risk to try to outperform or "get rich quick".

In part III, I will describe plans for allocating my personal assets into the Wealth Allocation Framework.

The reason the Wealth Allocation Framework appeals to me is because while reading the article, I realized that I had already started implementing this framework. The article formalized the allocation strategy I've been working on the last few months. The strategy is easy to understand and intuitive, so it makes perfect sense to me.

The problem with Modern Portfolio Theory is that at times the portfolio can still be too volatile (depending on the timeframe that performance is being measured at), and it does not consider my personal life and goals. The main reasons I would be disinclined to solely follow MPT are:

1. In serious bear markets, the stock allocation would make me uncomfortable. I'd have a difficult time watching my portfolio drop 25-50%, and would be tempted to take trading positions.

2. In a strong bull market, I'd be kicking myself for not having a more concentrated position in winners, which would greatly outperform the general market (this outperformance is one way of aspiring to move up in wealth percentile).

The Wealth Allocation Framework addresses these main issues. The strategy recommends allocating my assets into three categories: personal, market, and aspirational assets.

The personal assets are ones that I do not want to jeopardize under any circumstances. These assets are my protection for maintaining my standard of living. Even if all world stock markets and all real estate valuations go to zero, these assets would remain mostly intact. The appropriate level for personal assets would vary from household to household, and even for a single household over time. At my stage, personal assets include the roof over my head, and a comfortable level of stable investments in CDs, treasuries, munis, cash. Later, they may include life insurance, annuities, etc. Just beating inflation is a good goal for these assets.

The market assets allow me to keep up with the Joneses. These diversified assets should perform at the level of the general market. They would include mutual funds, managed funds, some bonds, small individual stock holdings, unleveraged rental property, small amounts of alternative investments for the purpose of diversification, small businesses, etc. These assets can be allocated according to Modern Portfolio Theory.

Finally, the aspirational assets are my longshot investments. If they succeed, my wealth percentile improves. If they fail, my lifestyle is not affected, and my risk is limited. This is money I can accept losing. These assets include leveraged real estate investments, private equity deals, risky business ventures, lottery tickets, a healthy dose of my company stock options, etc.

Over time, as one's wealth increases, the ratios of these assets would evolve. I may decide to move into a bigger home, thus increasing my allocation into personal assets. Eventually, I may decide that I have more than I'll ever need in my personal assets, and start allocating gains only into aspirational assets (this is what most rich people do, which is why the rich keep getting richer).

Judging from family, friends, and PF blogs, I feel that many people are financially lopsided, i.e. they are either too conservative or too aggressive. They either hold too much cash from apathy or fear, or they take on too much risk to try to outperform or "get rich quick".

In part III, I will describe plans for allocating my personal assets into the Wealth Allocation Framework.

Thursday, October 12, 2006

The Answer to Asset Allocation: Wealth Allocation Framework Part I

I had a follow-up meeting with Merrill Lynch and found this meeting to be very informative.

In the past, I have been uncomfortable with asset allocation, because asset allocation goes hand in hand with diversification. And diversification is a means for preserving wealth or for growing it slowly. No one will get rich with diversification in a 20 yr timeframe.

Although I have sold most of my company holdings, due to extreme appreciation over the years my remaining holdings still account for almost 50% of my net worth. Any asset allocator who follows modern portfolio theory (MPT, introduced by Harry Markowitz in 1952, for which he won the Nobel Prize in 1990) would advise that this is way too risky, and would recommend that I sell most of my remaining company stock and further diversify. I have been reluctant to do this, since I believe my company will continue to outperform the stock market for the forseeable future.

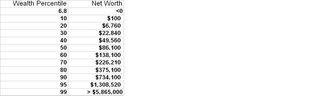

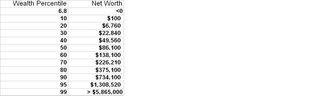

Consider the chart below which shows distribution of net worth of U.S. families in 2001:

You need a lot of money to increase your wealth percentile. For example, for a household to move from the 40th percentile to the 60th percentile, its net worth would need to triple!

To remain the 400th richest American in the Forbes 400 list, your networth would have had to increase sixfold over the last 20 yrs. The Consumer Price Index increased by only 90% during this time period.

So if you want to increase your relative wealth, you need some level of outperformance vs a portfolio developed based on MPT. The answer? The Wealth Allocation Framework, which I'll discuss more in my next post.

The points I brought up in this post were all drawn from Ashvin Chhabra's "Beyond Markowitz: A Comprehensive Wealth Allocation Framework for Individual Investors".

In the past, I have been uncomfortable with asset allocation, because asset allocation goes hand in hand with diversification. And diversification is a means for preserving wealth or for growing it slowly. No one will get rich with diversification in a 20 yr timeframe.

Although I have sold most of my company holdings, due to extreme appreciation over the years my remaining holdings still account for almost 50% of my net worth. Any asset allocator who follows modern portfolio theory (MPT, introduced by Harry Markowitz in 1952, for which he won the Nobel Prize in 1990) would advise that this is way too risky, and would recommend that I sell most of my remaining company stock and further diversify. I have been reluctant to do this, since I believe my company will continue to outperform the stock market for the forseeable future.

Consider the chart below which shows distribution of net worth of U.S. families in 2001:

You need a lot of money to increase your wealth percentile. For example, for a household to move from the 40th percentile to the 60th percentile, its net worth would need to triple!

To remain the 400th richest American in the Forbes 400 list, your networth would have had to increase sixfold over the last 20 yrs. The Consumer Price Index increased by only 90% during this time period.

So if you want to increase your relative wealth, you need some level of outperformance vs a portfolio developed based on MPT. The answer? The Wealth Allocation Framework, which I'll discuss more in my next post.

The points I brought up in this post were all drawn from Ashvin Chhabra's "Beyond Markowitz: A Comprehensive Wealth Allocation Framework for Individual Investors".

Subscribe to:

Posts (Atom)