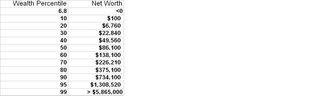

I haven't documented my networth since my May posting. So here's a quick update:

This simple little chart actually took a while to generate, because there is too much going on between the lines. I'm happy to be reorganizing my finances, because it just shouldn't be that complicated.

Some things going on between the lines:

1) Company stock shows $3M from May to Oct, which suggests I had no gains. But I actually sold off at least $300K worth of stock.

2) I paid out estimated taxes of almost $100K.

3) Some munis matured and I allocated the proceeds to a currency hedge.

4) I'm capturing only the big picture with rounded guestimates, there are actually multiple accounts behind various entries (need to simplify more, some accounts were mandated by my company's transactions over the years).

5) I haven't included cash flow being generated by investments (too much work).

6) Like everyone else, I got hit hard in May/June by the worldwide market correction, but bounced back strongly the last few months.

I'm going to put Quicken to work one of these days and get this 8-headed beast under control.

Big picture, for now I'd like to allocate to the Wealth Allocation Framework categories as follows.

Personal assets: ~$2M worth of CD's, munis, cash, treasuries, etc + $900K primary house

Market assets: ~$1.5M worth of managed accounts, mutual funds, etc + $300K second home.

Aspirational assets: ~$2.7M worth of company stock, high yield REI, private equity, etc.

When/if my assets grow another $1M, I'd split the $1M evenly between market and aspirational assets.

As I wrote in my last post, an adequate level for personal assets would vary from person to person, and even for a person as they pass through various stages of life. After spending the majority of my career dedicated to the success of my company, and watching my potential gains roller coaster between $0M and $40M, it would suck to lose it all. But I feel with $2M of safe assets and a house that's paid off, I will be able to sleep at night no matter what happens in the worldwide equity or real estate markets. I would have enough to handle one serious emergency. I would always have a place to call home. I could walk away from my job, satisfied with no regrets. Or I could watch my company lose its competitive edge or its relevance with determination but not despair. I expect these assets to grow at CPI+% after-tax. CPI is running at 3.8% for 2006, this is pretty tough to keep up with for high income tax bracket. CPI briefly spiked to 4.75% after Katrina (maybe that's why CD interest rates shot up for a short time and then came back down). It was as low as 1% during the worst part of the mini-recession in '00-'02.

For market assets, I'd like to hand half over to a professional money manager while I continue to manage half by myself. The bonds in my personal assets category will be held by the money manager to reduce his fees (fees get lower and lower as assets under management get higher, ideally I should keep at least $1M with the money manager). I will transfer more control over to the money manager as I gain confidence in him. I expect market assets to grow at 6-10% on the average.

For aspirational assets, I will always retain a large chunk of my company stock. I have kicked myself in the past for selling too early and missing out on huge potential gains. So I want to retain a substantial amount of exposure to my company performance. I expect these assets to grow at 8-sky's the limit%. Currently, my yield on the real estate investments range from 14-30% APR, and yield on my company stock is I-don't-want-to-think-about-it high.

As I mentioned, I had been moving towards the Wealth Allocation Framework without even knowing about it. So I'm actually not that far off from my target asset allocation. Currently, I'm at:

$1.637 M personal assets + $900K primary home

$1.260 M market assets + $300K second home

$3.265 M aspirational assets

To meet my asset allocation goals, I should sell off more company stock, and move the proceeds to the personal and market asset categories. If I had done this asset allocation earlier, I may not have made the real estate investments, since I want to retain heavy exposure to my company performance. I would also have saved on the taxes on those gains. I'm not sure that my asset level is high enough that I need to diversify into REI (since I'm not that familiar with it), maybe if I had another million or two of play money.

I find this last observation interesting, because I suspect a number of my fellow real estate investors have probably put most if not all their assets into this single asset category. Even though the deals we invested in are both commercial and residential, and diversified geographically, I would still consider them risky with high returns, which would make them aspirational assets.

In the future, I see all three asset categories growing at or above inflation rate. The base allocation for my personal assets will grow when I buy a bigger house, or start a family. The market assets will grow with equity appreciation; I may also add to these assets if my company's growth slows. The aspirational asset category should experience the most growth over the years, and eventually most gains will be allocated to this category.

After working through this asset allocation, my financial game plan is clear:

1. Decide on a money manager for half of my assets in the market class.

2. Sell a little more company stock and transfer proceeds to personal and market assets.

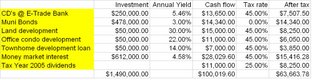

3. Put the rest of the cash in my personal assets category to work, with safe yields higher than CPI. I already have $350K in CDs yielding 5.46-6.45% (I didn't realize the rates would come down so fast, or I would have poured more assets in). I have $437K in tax-free munis yielding 3+%. The rest of my parked cash is earning 4.8% or lower. Merrill currently offers an effective yield of 5.8% on money market-like instruments. If I go with Merrill, I'd park my cash in these instruments.