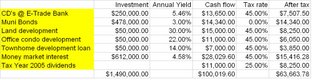

Without a lot of work, I've gotten my estimated annual cash flow up to a decent amount already. I am using the conservative numbers from the pro forma statements generated for my investments. Also, when doing my 2005 taxes, I found out that my dividends were still surprisingly low, so I was working on improving that over this past year also. It's hard to tell how much the dividends have improved without spending a lot of time on it, since each stock holding varies and dividends can change from quarter to quarter.

I am slowly moving the money market funds over into other investments. I think frugal has some great ideas at http://www.1stmillionat33.com/2006/06/list-of-high-yield-dividend-stocks/. In fact, I think that blog entry and his blog entry about MLPs were the most useful nuggets I've found in all of the blogosphere (As an aside, most other blogs I've glanced through write about saving or making a few dollars here or there - for example on no-interest credit card offers, or trying to squeeze an extra 0.1% out of some online banks. Nothing wrong with that, unless you can find other ways to make bigger money with your time.)

I still have not found the time to call up some private client groups to find out if they offer tax lien certificates, or real estate deals. I met a lady from Citibank's private client group several years back who said her group doled out vetted real estate deals to their clients.

4 comments:

I'm curious to hear how your investigation of non-traditional investments, like small businesses, are going. There's lots of discussion of deposit interest rates, but not much of how one finds these deals.

pyro, it's great that you are thinking about finances at such a young age. Time is definitely the most valuable asset.

I agree with you about squeezing money out of little things whenever you can do so efficiently. I like to save $5 for lunch when I eat at my company-subsidized cafeteria (saves my time too), clip significant coupons, buy things at discount. I am just mindful of how much time I spend saving or making a few cents or dollars.

Cool blog. Is the CA tax on dividends really 0%?

Thanks, moom. I've made the correction.

Post a Comment