In the past, I have been uncomfortable with asset allocation, because asset allocation goes hand in hand with diversification. And diversification is a means for preserving wealth or for growing it slowly. No one will get rich with diversification in a 20 yr timeframe.

Although I have sold most of my company holdings, due to extreme appreciation over the years my remaining holdings still account for almost 50% of my net worth. Any asset allocator who follows modern portfolio theory (MPT, introduced by Harry Markowitz in 1952, for which he won the Nobel Prize in 1990) would advise that this is way too risky, and would recommend that I sell most of my remaining company stock and further diversify. I have been reluctant to do this, since I believe my company will continue to outperform the stock market for the forseeable future.

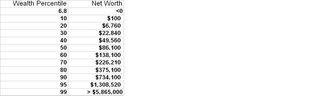

Consider the chart below which shows distribution of net worth of U.S. families in 2001:

You need a lot of money to increase your wealth percentile. For example, for a household to move from the 40th percentile to the 60th percentile, its net worth would need to triple!

To remain the 400th richest American in the Forbes 400 list, your networth would have had to increase sixfold over the last 20 yrs. The Consumer Price Index increased by only 90% during this time period.

So if you want to increase your relative wealth, you need some level of outperformance vs a portfolio developed based on MPT. The answer? The Wealth Allocation Framework, which I'll discuss more in my next post.

The points I brought up in this post were all drawn from Ashvin Chhabra's "Beyond Markowitz: A Comprehensive Wealth Allocation Framework for Individual Investors".

4 comments:

The Chhabra guy sounds like a genius

Your blog keeps getting better and better! Your older articles are not as good as newer ones you have a lot more creativity and originality now keep it up!

I wish not agree on it. I over precise post. Especially the designation attracted me to review the sound story.

Good fill someone in on and this enter helped me alot in my college assignement. Gratefulness you seeking your information.

Post a Comment