After requesting a leave of absence 8 months ago, my company finally let me start it. Today was the first workday since age 12 that I didn't work (other than weekends, holidays, and vacations of course).

What was the first thing I did? I went out and bought a monthly planner/journal. I've never owned one before. After detoxifying for the next few weeks by doing nothing, I want to make sure I don't waste the following months just watching TV. :)

After puttering around outside today during what previously were work hours for me, I must say I'm shocked by the number of working age people who aren't working! I was going to get a cup of coffee at Mercado's Starbucks, but there weren't any parking spaces available at 3 pm!

I have almost nothing planned, I was too busy with work to even think about plans for time off. Most people assume that I will do a lot of travelling, but I've already seen much of the world so I probably won't travel too much. I've already climbed the Great Wall of China, explored the mazes of the Grand Bazaar in Istanbul, wandered the pyramids of Chichen Itza, swam in the crystal blue waters of Cancun, hiked on glaciers in Alaska, tasted wine in the Tuscany countryside, cruised in the Mediterranean, the Carribean, and in Glacier Bay, gambled (just for fun) in Monte Carlo, learned to drive on the left side of the road and around the roundabouts in UK, searched for a sea monster in Loch Ness, explored the turrets of Edinburgh Castle, dived 1000 ft in a research submarine at the Cayman Islands, scaled the waterfall of Ochos Rios, snorkelled with sea turtles in Hawaii, witnessed the changing of the guard at Buckingham Palace, taken gondola rides in Venice, walked through the ruins of ancient Athens, toured the ruins of Ephesus, driven the length of the picturesque Amalfi coast, watched lightning strikes right outside my penthouse window at the Grand Hyatt in Shanghai, camped in a nomadic tent and rode miniature horses in the grasslands of Inner Mongolia, admired Michelangelo's masterpieces in the Vatican and Florence, relaxed on the shores of Lake Como in Bellagio, enjoyed the cherry blossoms of Kyoto during the season of sakura, marvelled at ice sculptures in Harbin, spelunked at the Carlsbad Caverns among 500,000 bats and in the limestone caves of Thailand, hiked the Grand Canyon, been awed by the grandeur of the Forbidden City, hiked in the rainforests of Xi Shuang Ban Na, viewed the 10000 clay warriors of Xian, eaten balitong and claypot specialties at the hawker stands of Penang and Singapore, toured the Louvre in Paris, the MOMA in NYC, the British Museum in London, the Smithsonian in DC, the National Palace Museum in Taipei, the Borghese Galleria in Rome, gone clubbing in the nightclubs of Shanghai in my younger years, witnessed a 15 ft long manta ray at the Atlantis Hotel on Paradise Island, cormorant fished on the Li River, seen the construction of the Yangtze River Dam, walked along active lava flows on the Big Island, sampled paella in Barcelona, along with dozens of other adventures.

I'm only starting to think about some plans, so far I've committed to climbing Half Dome at Yosemite, visiting friends in Chicago and Memphis, spending some time with relatives in Boston, attending my niece's graduation in San Diego, travelling with my uncle to Grenada, where he used to be a missionary.

I'm sure my months will fill out quickly. A life of golf is not for me.

Wednesday, March 21, 2007

Trimming positions in the morning

Wow, I did not expect the big stock market ramp today, so it warranted a review of my stock holdings at the end of the day. Thanks to some lucky side trades around my core positions during the volatility of the last few weeks, I'm back at all time highs in my diversified stock portfolio. All the recent fear-mongering over subprime amounted to much ado about nothing (for now). Looks like a golden opportunity to trim positions in the morning. I'm going to sell off everything that I picked up a couple of weeks ago, as well as all my small non-core positions. This will help simplify and focus my portfolio, without sacrificing diversification. It'll be a good feeling to do some spring-cleaning at all-time highs. I suspect others reviewing their portfolios will have the same idea, so here's hoping we don't get a -200 pt correction at opening bell - I won't sell if that happens.

Like everyone else, I am also expecting a big correction sometime this year. Which means the correction will probably never happen... :)

Like everyone else, I am also expecting a big correction sometime this year. Which means the correction will probably never happen... :)

Thursday, March 08, 2007

Choose to be rich

People often wonder how other people get rich. There aren't any secrets to becoming rich, you can get rich doing anything, even if you have no business sense or entrepeneurial spirit. You just need to make choices to give yourself the opportunity to be rich.

Recently, I've seen two examples of just such a choice. Let's call them Candy and Samantha (I changed their names, but they are real people). They have similar personalities - not particularly ambitious, not risk-takers, not entrepeneurial, with very limited investing experience. They both understand the concept of work-life balance, so they work 9-5 jobs, and enjoy active social lives outside of work. Neither spends any time balancing checkbooks (even Candy, the accountant!), nor thinking of ways to save a few dollars, and they both love to shop - sometimes extravagantly but never to the point that it won't be paid off within the month. They both made a recent decision that greatly changes their finances without sacrificing their way of life.

Candy had recently resigned from her previous position as a staff tax accountant, at which she earned $60 K annually. After receiving her resignation, management offered a promotion to tax manager with a salary increase to just under $70 K. Candy had been with her company for three years, and decided to widen her circle of opportunity by seeing what offers were available outside of her company also. She interviewed with several companies not local to her area. The offers ranged from staff positions to management positions, with salaries from $70 K to $110 K. The position she settled on originally offered her only $80 K, so she was going to reject the offer even though she though she liked the position - the offer was too far from the higher offers. But after I advised her to present them her then highest offer for $100 K, they immediately matched (another company offered her $110 K two days later). Additionally, the company offers the potential of up to 30% annual bonus, with average bonus at 15-20%. In the space of a few weeks, Candy's annual income went from $60 K to $100 K. She is only 29. Now she actually has a lighter workload than her previous job.

Key points: 1. Know your worth, don't sell yourself short. 2. Widen your options. 3. Everything is negotiable - including the details of the relocation package. 4. Choose the better job - easy right?

Samantha is 34 and in a very different field - cancer research. She graduated 1st in her undergraduate class from a highly regarded well-known university, and has a PhD in genetics from the same institution. For all her brilliance and years of experience, she was only making about $70 K a year. This is because she was working for a public research center, and she never thought much about how much she was paid as long as it was enough to live on. I frequently advised her to switch jobs, but she never took any action. After several years with the same employer, she finally made the switch outside of the public sector - her salary increased to $90 K, and she was granted some stock options. After only 6 short months with her new employer, her stock options are already worth $500 K. She consulted with me before accepting the position; I ran through the numbers with her and told her they were shortchanging her on the stock options. She was too timid/humble to ask for more, but I believe she could have asked for 2x what she got. But $500 K with a lot more upside ain't half bad, right? She's still doing the same kind of job she was doing before, with the same work hours, but now she's being compensated a lot more for the same work. The environment at her new job better enables her brilliance - more funding, a state-of-the-art lab, more resources all around.

Key points: 1. Negotiate. 2. Choose the job with upside potential. 3. Employers will offer the least amount that they think you will accept. 4. Public positions pay a lot lower (but have decent pensions if you stick around long enough). 5. If you spend your career as a non-management employee, the road to quick riches is through stock options. But don't choose any old company with stock options, choose a company where you believe in their future. Smaller companies offer a bigger share of the pie - there is a little extra job insecurity, but a) the potential payoff can be huge b) these days, job-hopping is common practice, and most jobs are insecure anyway. I interviewed at several companies before accepting an offer also - seeing a demo of their unreleased first product convinced me how revolutionary the company was, and talking with half of the employees there convinced me how smart my co-workers would be, so I wanted to be a part of it.

I think both Candy and Samantha are well on their way to becoming millionaires, on two different paths. But they share similar traits and habits: They are not entrepeneurial at all, and have no interest in doing any business outside of their 9-5 jobs. They both contribute to 401k, but talk to them about the stock market and they'll fall asleep or excuse themselves. They both look at real estate as a home to live in, not an investment. They both find challenge in and enjoy what they do for a living. Neither of them is dependent on the continued success of their employers - they both chose industries that they can easily find other positions in. Neither has any debt at all, except for the mortgage Samantha has on her SF house, and the one Candy has on her condo. They both pay off their credit card bills every month.

Recently, I've seen two examples of just such a choice. Let's call them Candy and Samantha (I changed their names, but they are real people). They have similar personalities - not particularly ambitious, not risk-takers, not entrepeneurial, with very limited investing experience. They both understand the concept of work-life balance, so they work 9-5 jobs, and enjoy active social lives outside of work. Neither spends any time balancing checkbooks (even Candy, the accountant!), nor thinking of ways to save a few dollars, and they both love to shop - sometimes extravagantly but never to the point that it won't be paid off within the month. They both made a recent decision that greatly changes their finances without sacrificing their way of life.

Candy had recently resigned from her previous position as a staff tax accountant, at which she earned $60 K annually. After receiving her resignation, management offered a promotion to tax manager with a salary increase to just under $70 K. Candy had been with her company for three years, and decided to widen her circle of opportunity by seeing what offers were available outside of her company also. She interviewed with several companies not local to her area. The offers ranged from staff positions to management positions, with salaries from $70 K to $110 K. The position she settled on originally offered her only $80 K, so she was going to reject the offer even though she though she liked the position - the offer was too far from the higher offers. But after I advised her to present them her then highest offer for $100 K, they immediately matched (another company offered her $110 K two days later). Additionally, the company offers the potential of up to 30% annual bonus, with average bonus at 15-20%. In the space of a few weeks, Candy's annual income went from $60 K to $100 K. She is only 29. Now she actually has a lighter workload than her previous job.

Key points: 1. Know your worth, don't sell yourself short. 2. Widen your options. 3. Everything is negotiable - including the details of the relocation package. 4. Choose the better job - easy right?

Samantha is 34 and in a very different field - cancer research. She graduated 1st in her undergraduate class from a highly regarded well-known university, and has a PhD in genetics from the same institution. For all her brilliance and years of experience, she was only making about $70 K a year. This is because she was working for a public research center, and she never thought much about how much she was paid as long as it was enough to live on. I frequently advised her to switch jobs, but she never took any action. After several years with the same employer, she finally made the switch outside of the public sector - her salary increased to $90 K, and she was granted some stock options. After only 6 short months with her new employer, her stock options are already worth $500 K. She consulted with me before accepting the position; I ran through the numbers with her and told her they were shortchanging her on the stock options. She was too timid/humble to ask for more, but I believe she could have asked for 2x what she got. But $500 K with a lot more upside ain't half bad, right? She's still doing the same kind of job she was doing before, with the same work hours, but now she's being compensated a lot more for the same work. The environment at her new job better enables her brilliance - more funding, a state-of-the-art lab, more resources all around.

Key points: 1. Negotiate. 2. Choose the job with upside potential. 3. Employers will offer the least amount that they think you will accept. 4. Public positions pay a lot lower (but have decent pensions if you stick around long enough). 5. If you spend your career as a non-management employee, the road to quick riches is through stock options. But don't choose any old company with stock options, choose a company where you believe in their future. Smaller companies offer a bigger share of the pie - there is a little extra job insecurity, but a) the potential payoff can be huge b) these days, job-hopping is common practice, and most jobs are insecure anyway. I interviewed at several companies before accepting an offer also - seeing a demo of their unreleased first product convinced me how revolutionary the company was, and talking with half of the employees there convinced me how smart my co-workers would be, so I wanted to be a part of it.

I think both Candy and Samantha are well on their way to becoming millionaires, on two different paths. But they share similar traits and habits: They are not entrepeneurial at all, and have no interest in doing any business outside of their 9-5 jobs. They both contribute to 401k, but talk to them about the stock market and they'll fall asleep or excuse themselves. They both look at real estate as a home to live in, not an investment. They both find challenge in and enjoy what they do for a living. Neither of them is dependent on the continued success of their employers - they both chose industries that they can easily find other positions in. Neither has any debt at all, except for the mortgage Samantha has on her SF house, and the one Candy has on her condo. They both pay off their credit card bills every month.

Wednesday, February 28, 2007

Finally, a stock market test

After months and months of smooth sailing on the markets, we finally got a little test yesterday with the Dow falling 546 points at one point.

I don't receive CNBC-TV, but I don't sense any fear in the air. The market simply corrected a bit from a massive months-long run-up. Unlike other big corrections over the past 10 years, this one generated almost no water cooler talk. My co-workers didn't talk about it. The 30 guys I played basketball with last night didn't talk about it. The local news focussed more on weather than on the stock market decline. It didn't get much attention at all. I don't even see much mention of the correction in all the PF blogs, which seem more interested in real estate deals. My personal feeling is that more declines are ahead, but also that the market won't take too long to recover. Unlike during the post-2000 correction, people aren't overly invested in the stock market, and seem adequately diversified into other investment areas (heavily overweighted in real estate), which should keep any large corrections from turning into a disaster. This is just my personal feeling, not based on any statistics, so please don't make any strategic decisions based on it.

I happened to see the bottom fall out of the market at Dow down 500+ and went in for a trade of DIA, QQQQ, and a couple of foreign ETFs, expecting a technical bounce after that massive 200 pt afternoon spike down in the Dow. I sold most of those positions already today for a quick 5% gain, since I'm expecting further large corrections in the not-too-distant future.

Yesterday was an excellent test of diversification strategy, so I reviewed the reactions of my various diversified holdings. I mentioned in an early post that I believe diversification doesn't help as much as one might expect, and this certainly seemed to be the case yesterday. Everything fell in concert - small cap, mid cap, large cap, value, growth, dividend plays, technology, domestic, foreign - European, Japanese, Asian ex-Japanese, emerging markets - Brazil/Russia/India/China, real estate funds, commodities, energy. EVERYTHING fell, except for bonds. I think that so many trading vehicles have been developed for every investment under the sun, that diversification just doesn't get you what it used to. You couldn't readily invest in gold a few years ago, but now that you can do so easily through the exchanges, gold has started tracking stocks. With all of the ADRs and foreign ETFs available now, the same has happened with foreign and emerging market stocks - they seem to be more correlated with US stocks and vice versa. What's the point of investing in gold if it falls even more than stocks during a stock market crash?

I am underweighted in commodities/gold, but the action yesterday is leading me to think it's not worth bothering to increase allocation in this area. However, bond/stock diversification seems to be a valid strategy. Currently, I have bond investments in individual munis, LSBRX, RPIBX, and some other miscellaneous bond funds. I'm looking to move more cash assets into bonds.

And still waiting for further market corrections to increase my diversified stock holdings in a more permanent manner.

I don't receive CNBC-TV, but I don't sense any fear in the air. The market simply corrected a bit from a massive months-long run-up. Unlike other big corrections over the past 10 years, this one generated almost no water cooler talk. My co-workers didn't talk about it. The 30 guys I played basketball with last night didn't talk about it. The local news focussed more on weather than on the stock market decline. It didn't get much attention at all. I don't even see much mention of the correction in all the PF blogs, which seem more interested in real estate deals. My personal feeling is that more declines are ahead, but also that the market won't take too long to recover. Unlike during the post-2000 correction, people aren't overly invested in the stock market, and seem adequately diversified into other investment areas (heavily overweighted in real estate), which should keep any large corrections from turning into a disaster. This is just my personal feeling, not based on any statistics, so please don't make any strategic decisions based on it.

I happened to see the bottom fall out of the market at Dow down 500+ and went in for a trade of DIA, QQQQ, and a couple of foreign ETFs, expecting a technical bounce after that massive 200 pt afternoon spike down in the Dow. I sold most of those positions already today for a quick 5% gain, since I'm expecting further large corrections in the not-too-distant future.

Yesterday was an excellent test of diversification strategy, so I reviewed the reactions of my various diversified holdings. I mentioned in an early post that I believe diversification doesn't help as much as one might expect, and this certainly seemed to be the case yesterday. Everything fell in concert - small cap, mid cap, large cap, value, growth, dividend plays, technology, domestic, foreign - European, Japanese, Asian ex-Japanese, emerging markets - Brazil/Russia/India/China, real estate funds, commodities, energy. EVERYTHING fell, except for bonds. I think that so many trading vehicles have been developed for every investment under the sun, that diversification just doesn't get you what it used to. You couldn't readily invest in gold a few years ago, but now that you can do so easily through the exchanges, gold has started tracking stocks. With all of the ADRs and foreign ETFs available now, the same has happened with foreign and emerging market stocks - they seem to be more correlated with US stocks and vice versa. What's the point of investing in gold if it falls even more than stocks during a stock market crash?

I am underweighted in commodities/gold, but the action yesterday is leading me to think it's not worth bothering to increase allocation in this area. However, bond/stock diversification seems to be a valid strategy. Currently, I have bond investments in individual munis, LSBRX, RPIBX, and some other miscellaneous bond funds. I'm looking to move more cash assets into bonds.

And still waiting for further market corrections to increase my diversified stock holdings in a more permanent manner.

Thursday, December 07, 2006

Net Worth Update for November

Out of curiosity, I went back and cleaned up my networth spreadsheet for the last few years. I'm including the most recent 6 months below. Performance has been outstanding, to the point that I lost what little sense of urgency I had in interviewing financial advisors. I will get back to interviewing in the next few weeks.

The main (only?) move I've been making is further diversifying out of my company stock. Of course, every single sale of company stock has thus far been a big mistake, but maybe one day I will appreciate the discipline.

From anecdotal evidence, I believe that there are many others with high cash positions waiting for a market correction to put money to work. After a strong months-long rally in the stock market, there seems to be a lot of bearish sentiment out there. I just don't see a substantial correction happening, there are too many people like me waiting for a correction to invest their cash horde. My cash position is even higher than shown, because I didn’t bother to break out the substantial cash holdings in my brokerage and bond accounts. The cash level in these accounts has increased considerably due to some profit-taking I did this week and also due to the maturing of bonds over time.

The main (only?) move I've been making is further diversifying out of my company stock. Of course, every single sale of company stock has thus far been a big mistake, but maybe one day I will appreciate the discipline.

From anecdotal evidence, I believe that there are many others with high cash positions waiting for a market correction to put money to work. After a strong months-long rally in the stock market, there seems to be a lot of bearish sentiment out there. I just don't see a substantial correction happening, there are too many people like me waiting for a correction to invest their cash horde. My cash position is even higher than shown, because I didn’t bother to break out the substantial cash holdings in my brokerage and bond accounts. The cash level in these accounts has increased considerably due to some profit-taking I did this week and also due to the maturing of bonds over time.

Window into the assets of the rich

Interested in how rich people allocate their assets? Just check out the 2005 detailed personal financial disclosures of the richest Congressmen:

http://www.opensecrets.org/pfds/overview.asp?type=W&cycle=2005&filter=A

Also, it's interesting to compare these disclosures against earlier years. Many Congressmen have doubled or tripled their net worth in the last 3 years thanks to booming stock markets and the real estate "bubble".

The largest sector where assets were held is in investment real estate.

http://www.opensecrets.org/pfds/overview.asp?type=W&cycle=2005&filter=A

Also, it's interesting to compare these disclosures against earlier years. Many Congressmen have doubled or tripled their net worth in the last 3 years thanks to booming stock markets and the real estate "bubble".

The largest sector where assets were held is in investment real estate.

Wednesday, November 01, 2006

The wealthy get bad advice, too

A friend of mine has most of his assets with a private wealth management group at a large financial services institution. I have no idea how much my friend is worth, but I do know that the minimum account size at this private wealth group is $25 million, and that they have managed his money for 8+ years.

A few months ago, The India Fund (IFN) announced a rights offering for current shareholders. This offering allowed current shareholders to purchase additional shares of IFN at a 5% discount to net asset value at a ratio of 3:1, i.e. for every 3 shares you own, you could purchase 1 additional share at the discounted price. Since IFN's premium was already 20+% over NAV at the time, this seemed like a no-brainer, instant free money. Although there was a little risk that IFN's price would drop closer to the NAV because of this offering, I mitigated this risk by waiting until the end of the offering period before exercising my rights. At that time, I was also offered an oversubscription priviledge which would allow me to pick up additional shares from those investors who chose not to exercise their rights. Since there was no limit to the number of shares I could request, I asked for 3x more additional shares on top of the ones I was exercising.

At the same time, I knew my friend was invested in IFN also, so I reminded him to exercise his rights, thinking that probably not everyone reads those prospectuses that gets sent out by the brokerage firms.

IFN's premium never narrowed down to the NAV price, and I got all the shares I requested (I had not expected to get any, thinking no one would pass up their rights to buy more). Once I got the shares in my account, I sold all my new shares for a quick 25% profit in less than a month. Of course, at the time I wondered, why didn't I request even more shares, it seemed like such an obvious decision.

When I spoke again with my friend, I found out that he did not even exercise his rights. Why? He didn't spend time reading the prospectus and had spoken with his account manager for advice. This account manager had advised him not to exercise his rights. I was really dumbfounded, and couldn't understand why. Since typically these account managers provide the same advice to all their clients, there must have been many more IFN shareholders who did not exercise their rights, which is why I was allocated all the additional shares I requested. I even wondered if my friend's financial institution itself was somehow profitting from this bad advice, possibly picking up the discounted shares, but I can't imagine they would violate their fiduciary responsibility like that.

Just goes to show you, even the wealthiest people get brain-dead advice.

I am in the process of interviewing more money managers now, and since I already have an account at my friend's institution, I interviewed a manager there also ($1 - $25 million accounts) for almost 3 hours. Unfortunately, so far I feel that even as a beginner I know more than these guys about money.

A few months ago, The India Fund (IFN) announced a rights offering for current shareholders. This offering allowed current shareholders to purchase additional shares of IFN at a 5% discount to net asset value at a ratio of 3:1, i.e. for every 3 shares you own, you could purchase 1 additional share at the discounted price. Since IFN's premium was already 20+% over NAV at the time, this seemed like a no-brainer, instant free money. Although there was a little risk that IFN's price would drop closer to the NAV because of this offering, I mitigated this risk by waiting until the end of the offering period before exercising my rights. At that time, I was also offered an oversubscription priviledge which would allow me to pick up additional shares from those investors who chose not to exercise their rights. Since there was no limit to the number of shares I could request, I asked for 3x more additional shares on top of the ones I was exercising.

At the same time, I knew my friend was invested in IFN also, so I reminded him to exercise his rights, thinking that probably not everyone reads those prospectuses that gets sent out by the brokerage firms.

IFN's premium never narrowed down to the NAV price, and I got all the shares I requested (I had not expected to get any, thinking no one would pass up their rights to buy more). Once I got the shares in my account, I sold all my new shares for a quick 25% profit in less than a month. Of course, at the time I wondered, why didn't I request even more shares, it seemed like such an obvious decision.

When I spoke again with my friend, I found out that he did not even exercise his rights. Why? He didn't spend time reading the prospectus and had spoken with his account manager for advice. This account manager had advised him not to exercise his rights. I was really dumbfounded, and couldn't understand why. Since typically these account managers provide the same advice to all their clients, there must have been many more IFN shareholders who did not exercise their rights, which is why I was allocated all the additional shares I requested. I even wondered if my friend's financial institution itself was somehow profitting from this bad advice, possibly picking up the discounted shares, but I can't imagine they would violate their fiduciary responsibility like that.

Just goes to show you, even the wealthiest people get brain-dead advice.

I am in the process of interviewing more money managers now, and since I already have an account at my friend's institution, I interviewed a manager there also ($1 - $25 million accounts) for almost 3 hours. Unfortunately, so far I feel that even as a beginner I know more than these guys about money.

Saturday, October 14, 2006

Notes on selecting a money manager

Additional questions to ask financial advisor:

1. What is the highest yield offered on money market-like instruments? (needs to beat CPI after tax)

2. What is the (lowest discounted) fee for equity and income assets for a $1M portfolio?

3. What are your views on MPT?

4. How many accounts are you currently managing?

5. What do you have to offer vs XXX financial institution, or vs XXX group within your institution (some of these institutions are so huge they have multiple groups competing for your assets)?

6. What contacts do you have for tax accountants and lawyers?

Signs that your financial advisor is doing right by you:

1. Recommended a 50-50 split between equity and fixed income for my asset level. Means lower commissions for him.

2. No hedge funds recommended for a $1M portfolio.

3. Showed me his own personal account statements, he was trying to demonstrate that he follows the same strategies himself for all of his assets (he has a decent chunk of change for his age).

4. Pretty straighforward about fees, showed me the entire proprietary fee schedule, including discounts. Broke down how fees are paid to money managers, wirehouse, and broker.

5. Sent me some free research reports and reading materials which I learned from.

1. What is the highest yield offered on money market-like instruments? (needs to beat CPI after tax)

2. What is the (lowest discounted) fee for equity and income assets for a $1M portfolio?

3. What are your views on MPT?

4. How many accounts are you currently managing?

5. What do you have to offer vs XXX financial institution, or vs XXX group within your institution (some of these institutions are so huge they have multiple groups competing for your assets)?

6. What contacts do you have for tax accountants and lawyers?

Signs that your financial advisor is doing right by you:

1. Recommended a 50-50 split between equity and fixed income for my asset level. Means lower commissions for him.

2. No hedge funds recommended for a $1M portfolio.

3. Showed me his own personal account statements, he was trying to demonstrate that he follows the same strategies himself for all of his assets (he has a decent chunk of change for his age).

4. Pretty straighforward about fees, showed me the entire proprietary fee schedule, including discounts. Broke down how fees are paid to money managers, wirehouse, and broker.

5. Sent me some free research reports and reading materials which I learned from.

Wealth Allocation Framework Part III

I haven't documented my networth since my May posting. So here's a quick update:

This simple little chart actually took a while to generate, because there is too much going on between the lines. I'm happy to be reorganizing my finances, because it just shouldn't be that complicated.

Some things going on between the lines:

1) Company stock shows $3M from May to Oct, which suggests I had no gains. But I actually sold off at least $300K worth of stock.

2) I paid out estimated taxes of almost $100K.

3) Some munis matured and I allocated the proceeds to a currency hedge.

4) I'm capturing only the big picture with rounded guestimates, there are actually multiple accounts behind various entries (need to simplify more, some accounts were mandated by my company's transactions over the years).

5) I haven't included cash flow being generated by investments (too much work).

6) Like everyone else, I got hit hard in May/June by the worldwide market correction, but bounced back strongly the last few months.

I'm going to put Quicken to work one of these days and get this 8-headed beast under control.

Big picture, for now I'd like to allocate to the Wealth Allocation Framework categories as follows.

Personal assets: ~$2M worth of CD's, munis, cash, treasuries, etc + $900K primary house

Market assets: ~$1.5M worth of managed accounts, mutual funds, etc + $300K second home.

Aspirational assets: ~$2.7M worth of company stock, high yield REI, private equity, etc.

When/if my assets grow another $1M, I'd split the $1M evenly between market and aspirational assets.

As I wrote in my last post, an adequate level for personal assets would vary from person to person, and even for a person as they pass through various stages of life. After spending the majority of my career dedicated to the success of my company, and watching my potential gains roller coaster between $0M and $40M, it would suck to lose it all. But I feel with $2M of safe assets and a house that's paid off, I will be able to sleep at night no matter what happens in the worldwide equity or real estate markets. I would have enough to handle one serious emergency. I would always have a place to call home. I could walk away from my job, satisfied with no regrets. Or I could watch my company lose its competitive edge or its relevance with determination but not despair. I expect these assets to grow at CPI+% after-tax. CPI is running at 3.8% for 2006, this is pretty tough to keep up with for high income tax bracket. CPI briefly spiked to 4.75% after Katrina (maybe that's why CD interest rates shot up for a short time and then came back down). It was as low as 1% during the worst part of the mini-recession in '00-'02.

For market assets, I'd like to hand half over to a professional money manager while I continue to manage half by myself. The bonds in my personal assets category will be held by the money manager to reduce his fees (fees get lower and lower as assets under management get higher, ideally I should keep at least $1M with the money manager). I will transfer more control over to the money manager as I gain confidence in him. I expect market assets to grow at 6-10% on the average.

For aspirational assets, I will always retain a large chunk of my company stock. I have kicked myself in the past for selling too early and missing out on huge potential gains. So I want to retain a substantial amount of exposure to my company performance. I expect these assets to grow at 8-sky's the limit%. Currently, my yield on the real estate investments range from 14-30% APR, and yield on my company stock is I-don't-want-to-think-about-it high.

As I mentioned, I had been moving towards the Wealth Allocation Framework without even knowing about it. So I'm actually not that far off from my target asset allocation. Currently, I'm at:

$1.637 M personal assets + $900K primary home

$1.260 M market assets + $300K second home

$3.265 M aspirational assets

To meet my asset allocation goals, I should sell off more company stock, and move the proceeds to the personal and market asset categories. If I had done this asset allocation earlier, I may not have made the real estate investments, since I want to retain heavy exposure to my company performance. I would also have saved on the taxes on those gains. I'm not sure that my asset level is high enough that I need to diversify into REI (since I'm not that familiar with it), maybe if I had another million or two of play money.

I find this last observation interesting, because I suspect a number of my fellow real estate investors have probably put most if not all their assets into this single asset category. Even though the deals we invested in are both commercial and residential, and diversified geographically, I would still consider them risky with high returns, which would make them aspirational assets.

In the future, I see all three asset categories growing at or above inflation rate. The base allocation for my personal assets will grow when I buy a bigger house, or start a family. The market assets will grow with equity appreciation; I may also add to these assets if my company's growth slows. The aspirational asset category should experience the most growth over the years, and eventually most gains will be allocated to this category.

After working through this asset allocation, my financial game plan is clear:

1. Decide on a money manager for half of my assets in the market class.

2. Sell a little more company stock and transfer proceeds to personal and market assets.

3. Put the rest of the cash in my personal assets category to work, with safe yields higher than CPI. I already have $350K in CDs yielding 5.46-6.45% (I didn't realize the rates would come down so fast, or I would have poured more assets in). I have $437K in tax-free munis yielding 3+%. The rest of my parked cash is earning 4.8% or lower. Merrill currently offers an effective yield of 5.8% on money market-like instruments. If I go with Merrill, I'd park my cash in these instruments.

This simple little chart actually took a while to generate, because there is too much going on between the lines. I'm happy to be reorganizing my finances, because it just shouldn't be that complicated.

Some things going on between the lines:

1) Company stock shows $3M from May to Oct, which suggests I had no gains. But I actually sold off at least $300K worth of stock.

2) I paid out estimated taxes of almost $100K.

3) Some munis matured and I allocated the proceeds to a currency hedge.

4) I'm capturing only the big picture with rounded guestimates, there are actually multiple accounts behind various entries (need to simplify more, some accounts were mandated by my company's transactions over the years).

5) I haven't included cash flow being generated by investments (too much work).

6) Like everyone else, I got hit hard in May/June by the worldwide market correction, but bounced back strongly the last few months.

I'm going to put Quicken to work one of these days and get this 8-headed beast under control.

Big picture, for now I'd like to allocate to the Wealth Allocation Framework categories as follows.

Personal assets: ~$2M worth of CD's, munis, cash, treasuries, etc + $900K primary house

Market assets: ~$1.5M worth of managed accounts, mutual funds, etc + $300K second home.

Aspirational assets: ~$2.7M worth of company stock, high yield REI, private equity, etc.

When/if my assets grow another $1M, I'd split the $1M evenly between market and aspirational assets.

As I wrote in my last post, an adequate level for personal assets would vary from person to person, and even for a person as they pass through various stages of life. After spending the majority of my career dedicated to the success of my company, and watching my potential gains roller coaster between $0M and $40M, it would suck to lose it all. But I feel with $2M of safe assets and a house that's paid off, I will be able to sleep at night no matter what happens in the worldwide equity or real estate markets. I would have enough to handle one serious emergency. I would always have a place to call home. I could walk away from my job, satisfied with no regrets. Or I could watch my company lose its competitive edge or its relevance with determination but not despair. I expect these assets to grow at CPI+% after-tax. CPI is running at 3.8% for 2006, this is pretty tough to keep up with for high income tax bracket. CPI briefly spiked to 4.75% after Katrina (maybe that's why CD interest rates shot up for a short time and then came back down). It was as low as 1% during the worst part of the mini-recession in '00-'02.

For market assets, I'd like to hand half over to a professional money manager while I continue to manage half by myself. The bonds in my personal assets category will be held by the money manager to reduce his fees (fees get lower and lower as assets under management get higher, ideally I should keep at least $1M with the money manager). I will transfer more control over to the money manager as I gain confidence in him. I expect market assets to grow at 6-10% on the average.

For aspirational assets, I will always retain a large chunk of my company stock. I have kicked myself in the past for selling too early and missing out on huge potential gains. So I want to retain a substantial amount of exposure to my company performance. I expect these assets to grow at 8-sky's the limit%. Currently, my yield on the real estate investments range from 14-30% APR, and yield on my company stock is I-don't-want-to-think-about-it high.

As I mentioned, I had been moving towards the Wealth Allocation Framework without even knowing about it. So I'm actually not that far off from my target asset allocation. Currently, I'm at:

$1.637 M personal assets + $900K primary home

$1.260 M market assets + $300K second home

$3.265 M aspirational assets

To meet my asset allocation goals, I should sell off more company stock, and move the proceeds to the personal and market asset categories. If I had done this asset allocation earlier, I may not have made the real estate investments, since I want to retain heavy exposure to my company performance. I would also have saved on the taxes on those gains. I'm not sure that my asset level is high enough that I need to diversify into REI (since I'm not that familiar with it), maybe if I had another million or two of play money.

I find this last observation interesting, because I suspect a number of my fellow real estate investors have probably put most if not all their assets into this single asset category. Even though the deals we invested in are both commercial and residential, and diversified geographically, I would still consider them risky with high returns, which would make them aspirational assets.

In the future, I see all three asset categories growing at or above inflation rate. The base allocation for my personal assets will grow when I buy a bigger house, or start a family. The market assets will grow with equity appreciation; I may also add to these assets if my company's growth slows. The aspirational asset category should experience the most growth over the years, and eventually most gains will be allocated to this category.

After working through this asset allocation, my financial game plan is clear:

1. Decide on a money manager for half of my assets in the market class.

2. Sell a little more company stock and transfer proceeds to personal and market assets.

3. Put the rest of the cash in my personal assets category to work, with safe yields higher than CPI. I already have $350K in CDs yielding 5.46-6.45% (I didn't realize the rates would come down so fast, or I would have poured more assets in). I have $437K in tax-free munis yielding 3+%. The rest of my parked cash is earning 4.8% or lower. Merrill currently offers an effective yield of 5.8% on money market-like instruments. If I go with Merrill, I'd park my cash in these instruments.

Wealth Allocation Framework Defined Part II

I'll briefly go over the basic concepts of the Wealth Allocation Framework, and refer you to Ashvin Chhabra's "Beyond Markowitz: A Comprehensive Wealth Allocation Framework for Individual Investors" for details.

The reason the Wealth Allocation Framework appeals to me is because while reading the article, I realized that I had already started implementing this framework. The article formalized the allocation strategy I've been working on the last few months. The strategy is easy to understand and intuitive, so it makes perfect sense to me.

The problem with Modern Portfolio Theory is that at times the portfolio can still be too volatile (depending on the timeframe that performance is being measured at), and it does not consider my personal life and goals. The main reasons I would be disinclined to solely follow MPT are:

1. In serious bear markets, the stock allocation would make me uncomfortable. I'd have a difficult time watching my portfolio drop 25-50%, and would be tempted to take trading positions.

2. In a strong bull market, I'd be kicking myself for not having a more concentrated position in winners, which would greatly outperform the general market (this outperformance is one way of aspiring to move up in wealth percentile).

The Wealth Allocation Framework addresses these main issues. The strategy recommends allocating my assets into three categories: personal, market, and aspirational assets.

The personal assets are ones that I do not want to jeopardize under any circumstances. These assets are my protection for maintaining my standard of living. Even if all world stock markets and all real estate valuations go to zero, these assets would remain mostly intact. The appropriate level for personal assets would vary from household to household, and even for a single household over time. At my stage, personal assets include the roof over my head, and a comfortable level of stable investments in CDs, treasuries, munis, cash. Later, they may include life insurance, annuities, etc. Just beating inflation is a good goal for these assets.

The market assets allow me to keep up with the Joneses. These diversified assets should perform at the level of the general market. They would include mutual funds, managed funds, some bonds, small individual stock holdings, unleveraged rental property, small amounts of alternative investments for the purpose of diversification, small businesses, etc. These assets can be allocated according to Modern Portfolio Theory.

Finally, the aspirational assets are my longshot investments. If they succeed, my wealth percentile improves. If they fail, my lifestyle is not affected, and my risk is limited. This is money I can accept losing. These assets include leveraged real estate investments, private equity deals, risky business ventures, lottery tickets, a healthy dose of my company stock options, etc.

Over time, as one's wealth increases, the ratios of these assets would evolve. I may decide to move into a bigger home, thus increasing my allocation into personal assets. Eventually, I may decide that I have more than I'll ever need in my personal assets, and start allocating gains only into aspirational assets (this is what most rich people do, which is why the rich keep getting richer).

Judging from family, friends, and PF blogs, I feel that many people are financially lopsided, i.e. they are either too conservative or too aggressive. They either hold too much cash from apathy or fear, or they take on too much risk to try to outperform or "get rich quick".

In part III, I will describe plans for allocating my personal assets into the Wealth Allocation Framework.

The reason the Wealth Allocation Framework appeals to me is because while reading the article, I realized that I had already started implementing this framework. The article formalized the allocation strategy I've been working on the last few months. The strategy is easy to understand and intuitive, so it makes perfect sense to me.

The problem with Modern Portfolio Theory is that at times the portfolio can still be too volatile (depending on the timeframe that performance is being measured at), and it does not consider my personal life and goals. The main reasons I would be disinclined to solely follow MPT are:

1. In serious bear markets, the stock allocation would make me uncomfortable. I'd have a difficult time watching my portfolio drop 25-50%, and would be tempted to take trading positions.

2. In a strong bull market, I'd be kicking myself for not having a more concentrated position in winners, which would greatly outperform the general market (this outperformance is one way of aspiring to move up in wealth percentile).

The Wealth Allocation Framework addresses these main issues. The strategy recommends allocating my assets into three categories: personal, market, and aspirational assets.

The personal assets are ones that I do not want to jeopardize under any circumstances. These assets are my protection for maintaining my standard of living. Even if all world stock markets and all real estate valuations go to zero, these assets would remain mostly intact. The appropriate level for personal assets would vary from household to household, and even for a single household over time. At my stage, personal assets include the roof over my head, and a comfortable level of stable investments in CDs, treasuries, munis, cash. Later, they may include life insurance, annuities, etc. Just beating inflation is a good goal for these assets.

The market assets allow me to keep up with the Joneses. These diversified assets should perform at the level of the general market. They would include mutual funds, managed funds, some bonds, small individual stock holdings, unleveraged rental property, small amounts of alternative investments for the purpose of diversification, small businesses, etc. These assets can be allocated according to Modern Portfolio Theory.

Finally, the aspirational assets are my longshot investments. If they succeed, my wealth percentile improves. If they fail, my lifestyle is not affected, and my risk is limited. This is money I can accept losing. These assets include leveraged real estate investments, private equity deals, risky business ventures, lottery tickets, a healthy dose of my company stock options, etc.

Over time, as one's wealth increases, the ratios of these assets would evolve. I may decide to move into a bigger home, thus increasing my allocation into personal assets. Eventually, I may decide that I have more than I'll ever need in my personal assets, and start allocating gains only into aspirational assets (this is what most rich people do, which is why the rich keep getting richer).

Judging from family, friends, and PF blogs, I feel that many people are financially lopsided, i.e. they are either too conservative or too aggressive. They either hold too much cash from apathy or fear, or they take on too much risk to try to outperform or "get rich quick".

In part III, I will describe plans for allocating my personal assets into the Wealth Allocation Framework.

Thursday, October 12, 2006

The Answer to Asset Allocation: Wealth Allocation Framework Part I

I had a follow-up meeting with Merrill Lynch and found this meeting to be very informative.

In the past, I have been uncomfortable with asset allocation, because asset allocation goes hand in hand with diversification. And diversification is a means for preserving wealth or for growing it slowly. No one will get rich with diversification in a 20 yr timeframe.

Although I have sold most of my company holdings, due to extreme appreciation over the years my remaining holdings still account for almost 50% of my net worth. Any asset allocator who follows modern portfolio theory (MPT, introduced by Harry Markowitz in 1952, for which he won the Nobel Prize in 1990) would advise that this is way too risky, and would recommend that I sell most of my remaining company stock and further diversify. I have been reluctant to do this, since I believe my company will continue to outperform the stock market for the forseeable future.

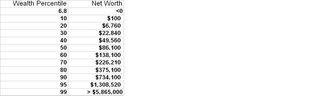

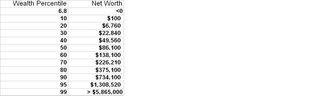

Consider the chart below which shows distribution of net worth of U.S. families in 2001:

You need a lot of money to increase your wealth percentile. For example, for a household to move from the 40th percentile to the 60th percentile, its net worth would need to triple!

To remain the 400th richest American in the Forbes 400 list, your networth would have had to increase sixfold over the last 20 yrs. The Consumer Price Index increased by only 90% during this time period.

So if you want to increase your relative wealth, you need some level of outperformance vs a portfolio developed based on MPT. The answer? The Wealth Allocation Framework, which I'll discuss more in my next post.

The points I brought up in this post were all drawn from Ashvin Chhabra's "Beyond Markowitz: A Comprehensive Wealth Allocation Framework for Individual Investors".

In the past, I have been uncomfortable with asset allocation, because asset allocation goes hand in hand with diversification. And diversification is a means for preserving wealth or for growing it slowly. No one will get rich with diversification in a 20 yr timeframe.

Although I have sold most of my company holdings, due to extreme appreciation over the years my remaining holdings still account for almost 50% of my net worth. Any asset allocator who follows modern portfolio theory (MPT, introduced by Harry Markowitz in 1952, for which he won the Nobel Prize in 1990) would advise that this is way too risky, and would recommend that I sell most of my remaining company stock and further diversify. I have been reluctant to do this, since I believe my company will continue to outperform the stock market for the forseeable future.

Consider the chart below which shows distribution of net worth of U.S. families in 2001:

You need a lot of money to increase your wealth percentile. For example, for a household to move from the 40th percentile to the 60th percentile, its net worth would need to triple!

To remain the 400th richest American in the Forbes 400 list, your networth would have had to increase sixfold over the last 20 yrs. The Consumer Price Index increased by only 90% during this time period.

So if you want to increase your relative wealth, you need some level of outperformance vs a portfolio developed based on MPT. The answer? The Wealth Allocation Framework, which I'll discuss more in my next post.

The points I brought up in this post were all drawn from Ashvin Chhabra's "Beyond Markowitz: A Comprehensive Wealth Allocation Framework for Individual Investors".

Thursday, September 14, 2006

Put a little cash to work

The only reason I was looking for alternative investments when I started blogging is that I couldn't find any good investments with decent yield.

The environment has changed quite a bit in just a few months. For one thing, I found a 7-month CD yielding 6.45% at a local credit union, so I put 100K into it. I would have put a lot more into it, but didn't because of the 100K FDIC limitation.

I put 50K into a currency trade product offered by Morgan Stanley. It's a capital-protected hedge against a falling dollar vs a basket of emerging market currencies. I don't have the prospectus readily available, but essentially if the dollar falls against a basket of Brazilian, Russian, Indian, and Chinese currencies by 2008, I make ~7.5% APR. The more it falls, the higher my return. Should the dollar rise vs those currencies, I get my original investment back. I had to really think about this vs buying more CDs at 6.45%, but thought it was a decent bet.

The decline in energy and precious metals over the last few months finally enticed me enough to put a little cash to work in stocks a couple of days ago. I targetted yield (REITs and energy trusts), energy stocks, and gold stocks. I am underinvested in these areas but didn't want to put money in when they were at such lofty levels. I expect oil and energy to decline further, so I'm just starting to scale in. One oil stock I picked up is DVN, this company made a recent discovery in the Gulf of Mexico that potentially doubles their reserves, but the stock didn't move. I'm surprised by the lack of interest, since I see lots of media coverage. This is what happens during distribution, and signals to me that energy has further to fall. Energy is still at very high valuations, and could fall for a long time.

I considered housing (KBH, TOL, PHM), because of the extreme pessimism in that sector over the past year. I regret not making some small purchases there (look how it's done over the past week). But time will tell whether this is just a temporary rebound. Meanwhile, I wait patiently to see what happens.

I am also waiting to pull the trigger on buying healthcare funds. I think this is a good sector to be in for the next couple of decades. A lot of stocks in this sector have been moving sideways for years, and action has started to look interesting the last few weeks.

I am still holding a lot of cash, but now that money market yields are all close to 5%, I'm not in any hurry to deploy. I think my cash position is even higher than a month ago despite putting another 250K to work, as I've vested more company options which I subsequently sold, made some huge gains on ESPP, and have been selling off long-term company stock holdings too (it's near an all time high).

The environment has changed quite a bit in just a few months. For one thing, I found a 7-month CD yielding 6.45% at a local credit union, so I put 100K into it. I would have put a lot more into it, but didn't because of the 100K FDIC limitation.

I put 50K into a currency trade product offered by Morgan Stanley. It's a capital-protected hedge against a falling dollar vs a basket of emerging market currencies. I don't have the prospectus readily available, but essentially if the dollar falls against a basket of Brazilian, Russian, Indian, and Chinese currencies by 2008, I make ~7.5% APR. The more it falls, the higher my return. Should the dollar rise vs those currencies, I get my original investment back. I had to really think about this vs buying more CDs at 6.45%, but thought it was a decent bet.

The decline in energy and precious metals over the last few months finally enticed me enough to put a little cash to work in stocks a couple of days ago. I targetted yield (REITs and energy trusts), energy stocks, and gold stocks. I am underinvested in these areas but didn't want to put money in when they were at such lofty levels. I expect oil and energy to decline further, so I'm just starting to scale in. One oil stock I picked up is DVN, this company made a recent discovery in the Gulf of Mexico that potentially doubles their reserves, but the stock didn't move. I'm surprised by the lack of interest, since I see lots of media coverage. This is what happens during distribution, and signals to me that energy has further to fall. Energy is still at very high valuations, and could fall for a long time.

I considered housing (KBH, TOL, PHM), because of the extreme pessimism in that sector over the past year. I regret not making some small purchases there (look how it's done over the past week). But time will tell whether this is just a temporary rebound. Meanwhile, I wait patiently to see what happens.

I am also waiting to pull the trigger on buying healthcare funds. I think this is a good sector to be in for the next couple of decades. A lot of stocks in this sector have been moving sideways for years, and action has started to look interesting the last few weeks.

I am still holding a lot of cash, but now that money market yields are all close to 5%, I'm not in any hurry to deploy. I think my cash position is even higher than a month ago despite putting another 250K to work, as I've vested more company options which I subsequently sold, made some huge gains on ESPP, and have been selling off long-term company stock holdings too (it's near an all time high).

Diversification, again

I came across a blog I found interesting:

http://uhnwi.livejournal.com

He discusses some topics I wish I had exposure to several years ago.

But I'm practically screaming, "Are you crazy?!! Sell, sell, sell!!!!!!"

I guess the author probably has ~$30 million or more concentrated in company options, and doesn't want to sell because of capital gains taxes. For some reason, he seems to think his company is invincible (must be a Google employee :P ). I have seen enough over the years (especially during the dotcom crash) that I wouldn't be comfortable to be 100% invested in company options. It's true that to achieve extreme wealth financially, you have to be focussed rather than diversified. But to not diversify once you hit $30M, or even $10M, is just plain folly. What do you think?

Enron and WorldCom both seemed invincible at one time.

http://uhnwi.livejournal.com

He discusses some topics I wish I had exposure to several years ago.

But I'm practically screaming, "Are you crazy?!! Sell, sell, sell!!!!!!"

I guess the author probably has ~$30 million or more concentrated in company options, and doesn't want to sell because of capital gains taxes. For some reason, he seems to think his company is invincible (must be a Google employee :P ). I have seen enough over the years (especially during the dotcom crash) that I wouldn't be comfortable to be 100% invested in company options. It's true that to achieve extreme wealth financially, you have to be focussed rather than diversified. But to not diversify once you hit $30M, or even $10M, is just plain folly. What do you think?

Enron and WorldCom both seemed invincible at one time.

Saturday, September 02, 2006

My date with Merrill (Lynch)

Has anyone seen "My Date with Drew"? I thought it was a cool movie, shows how someone can achieve what seems to be impossible on nothing but desire and tenacity.

I spent over an hour interviewing a financial advisor from Merrill Lynch's private client group. The goal of the meeting was to find out what Merrill could do for me, and his proposal for financial strategy.

I had given him a list of some of my mutual fund holdings, and he went through some analysis for me. His goal was to convert me from mutual funds to managed funds and hedge funds. Here are some key points that I've gleaned from the meeting, my own past experience with managed funds, and some discussion with an ex-Merrill Lynch client:

1. Minimum account they're willing to work with is ~600K. Typical managed fund and hedge fund minimums are 100K, so 600K would be enough to start 3 managed funds and 3 hedge funds, all with different management styles.

2. Average account size in this private client group is $2M.

3. Managed accounts allow you to tax loss harvest at the end of the year. You can advise the manager of your tax situation (i.e. that you have capital gains you want to offset), and instruct them to take individual stock losses against your gains. This is something you wouldn't be able to do with a mutual fund, since you have no control over the underlying fund assets.

4. You purchase the underlying shares in the managed account, so your cost basis is the actual share price on the date of purchase. When those shares are sold, you are taxed on actual gains (or losses). For mutual funds, when you purchase the mutual fund, the fund already holds those underlying shares, likely with a cost basis lower than the market price at the time you made the purchase. When the mutual fund makes a distribution, you are taxed on the gains the fund made from its original purchase price, not at the price you paid. Your fund could have lost value, but you'd still have to pay capital tax on the distribution. This is awful, and so is another big benefit of managed funds.

5. Management fees. Merrill charges its own 1+% fee, and the managers charge another 1-2%, so the fees add up. However, mutual funds have hidden fees besides the management fees shown on Yahoo finance, including transaction costs and taxes. www.personalfund.com has more details of all the costs associated with a particular fund. Depending on the fund, Merrill's fees may actually work out to be lower. But if you're going for lowest costs, ETFs or Vanguard funds would be good bets.

6. Tax complications. If you own hedge funds, you will probably have to file for tax return extensions every year, because you don't receive final tax documents (K-1s) until after April 15.

7. Hedge funds did well in 2000-2002, but many of them seem to be lagging the market from 2003-present. This is probably related to the huge amount of money being poured into hedge funds the last several years. One thing I like about hedge funds is that their volatility seems to be generally lower than the overall market.

8. They don't offer tax liens or real estate deals. Need to go with Citibank for those.

My conclusion? If you've got all the time in the world, it's better for you to do your own research and manage individual stocks. For those with net worth less than a few hundred K and no time, stick with ETFs, mutual funds, and some individual stocks. For those with net worth > $1M and no time, it's still kind of a toss-up, fund selection is key whether you go with mutual or managed funds. For those with net worth > $5M, you pretty much need someone to help you diversify.

I'm going to stay the course and not go with Merrill yet. Will interview more financial advisors. It's a time-consuming task.

I spent over an hour interviewing a financial advisor from Merrill Lynch's private client group. The goal of the meeting was to find out what Merrill could do for me, and his proposal for financial strategy.

I had given him a list of some of my mutual fund holdings, and he went through some analysis for me. His goal was to convert me from mutual funds to managed funds and hedge funds. Here are some key points that I've gleaned from the meeting, my own past experience with managed funds, and some discussion with an ex-Merrill Lynch client:

1. Minimum account they're willing to work with is ~600K. Typical managed fund and hedge fund minimums are 100K, so 600K would be enough to start 3 managed funds and 3 hedge funds, all with different management styles.

2. Average account size in this private client group is $2M.

3. Managed accounts allow you to tax loss harvest at the end of the year. You can advise the manager of your tax situation (i.e. that you have capital gains you want to offset), and instruct them to take individual stock losses against your gains. This is something you wouldn't be able to do with a mutual fund, since you have no control over the underlying fund assets.

4. You purchase the underlying shares in the managed account, so your cost basis is the actual share price on the date of purchase. When those shares are sold, you are taxed on actual gains (or losses). For mutual funds, when you purchase the mutual fund, the fund already holds those underlying shares, likely with a cost basis lower than the market price at the time you made the purchase. When the mutual fund makes a distribution, you are taxed on the gains the fund made from its original purchase price, not at the price you paid. Your fund could have lost value, but you'd still have to pay capital tax on the distribution. This is awful, and so is another big benefit of managed funds.

5. Management fees. Merrill charges its own 1+% fee, and the managers charge another 1-2%, so the fees add up. However, mutual funds have hidden fees besides the management fees shown on Yahoo finance, including transaction costs and taxes. www.personalfund.com has more details of all the costs associated with a particular fund. Depending on the fund, Merrill's fees may actually work out to be lower. But if you're going for lowest costs, ETFs or Vanguard funds would be good bets.

6. Tax complications. If you own hedge funds, you will probably have to file for tax return extensions every year, because you don't receive final tax documents (K-1s) until after April 15.

7. Hedge funds did well in 2000-2002, but many of them seem to be lagging the market from 2003-present. This is probably related to the huge amount of money being poured into hedge funds the last several years. One thing I like about hedge funds is that their volatility seems to be generally lower than the overall market.

8. They don't offer tax liens or real estate deals. Need to go with Citibank for those.

My conclusion? If you've got all the time in the world, it's better for you to do your own research and manage individual stocks. For those with net worth less than a few hundred K and no time, stick with ETFs, mutual funds, and some individual stocks. For those with net worth > $1M and no time, it's still kind of a toss-up, fund selection is key whether you go with mutual or managed funds. For those with net worth > $5M, you pretty much need someone to help you diversify.

I'm going to stay the course and not go with Merrill yet. Will interview more financial advisors. It's a time-consuming task.

Saturday, July 22, 2006

Cash flow update

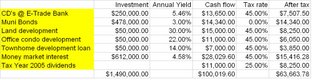

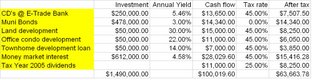

Most blogs I've seen publish a monthly balance sheet with assets and liabilities. I think a more useful financial statement for me is the cash flow statement. This statement is what I've been working on improving the past month or so. Here is an estimate of where it currently stands:

Without a lot of work, I've gotten my estimated annual cash flow up to a decent amount already. I am using the conservative numbers from the pro forma statements generated for my investments. Also, when doing my 2005 taxes, I found out that my dividends were still surprisingly low, so I was working on improving that over this past year also. It's hard to tell how much the dividends have improved without spending a lot of time on it, since each stock holding varies and dividends can change from quarter to quarter.

I am slowly moving the money market funds over into other investments. I think frugal has some great ideas at http://www.1stmillionat33.com/2006/06/list-of-high-yield-dividend-stocks/. In fact, I think that blog entry and his blog entry about MLPs were the most useful nuggets I've found in all of the blogosphere (As an aside, most other blogs I've glanced through write about saving or making a few dollars here or there - for example on no-interest credit card offers, or trying to squeeze an extra 0.1% out of some online banks. Nothing wrong with that, unless you can find other ways to make bigger money with your time.)

I still have not found the time to call up some private client groups to find out if they offer tax lien certificates, or real estate deals. I met a lady from Citibank's private client group several years back who said her group doled out vetted real estate deals to their clients.

Without a lot of work, I've gotten my estimated annual cash flow up to a decent amount already. I am using the conservative numbers from the pro forma statements generated for my investments. Also, when doing my 2005 taxes, I found out that my dividends were still surprisingly low, so I was working on improving that over this past year also. It's hard to tell how much the dividends have improved without spending a lot of time on it, since each stock holding varies and dividends can change from quarter to quarter.

I am slowly moving the money market funds over into other investments. I think frugal has some great ideas at http://www.1stmillionat33.com/2006/06/list-of-high-yield-dividend-stocks/. In fact, I think that blog entry and his blog entry about MLPs were the most useful nuggets I've found in all of the blogosphere (As an aside, most other blogs I've glanced through write about saving or making a few dollars here or there - for example on no-interest credit card offers, or trying to squeeze an extra 0.1% out of some online banks. Nothing wrong with that, unless you can find other ways to make bigger money with your time.)

I still have not found the time to call up some private client groups to find out if they offer tax lien certificates, or real estate deals. I met a lady from Citibank's private client group several years back who said her group doled out vetted real estate deals to their clients.

The biggest roadblock to wealth

I think the biggest roadblock to wealth is a person's own mind, and way of thinking. The most common emotions that get in the way are fear and apathy. Here are some common reasons that prevent people from investing or making more money:

some examples of fear:

1. I don't have much. I don't want to lose it.

2. That's too risky.

3. I'll invest once I make more money.

4. I remember the last time I took a chance.

5. I have a wife and kids, I can't afford to be wrong.

some examples of apathy:

1. I make enough and I can live well with what I make, I don't need to make more.

2. I'm too busy with my job, I don't have time for investing outside of work.

3. I'll never figure out this investment stuff, it's too complicated.

4. I'll invest when I see a good opportunity that comes along.

5. Oh, I never even thought about investing or ways to make more money.

6. The game is rigged. Nobody can make money unless you're on the inside.

I purposefully picked some examples that totally make sense to me. I definitely fall into the fear camp, but I can totally understand the apathy camp too.

Now that I'm making active investments outside of work (other than stocks + mutual funds), I've reflected on why I didn't do it earlier. I think it's because my frame of mind has changed.

From reflection, I can remember a lot of opportunities that I passed up in the past, because of fear or apathy:

1. In '99 I was given a pre-IPO offer with a big options package by the founder of what is one of the largest communications semiconductor companies now (worth over $20B before this recent market collapse). I had just been through a start-up experience, so turned down the offer because I thought I was too burned out to do another one even though I was 100% sure they would hit it big (I ended up working just as hard at the job I didn't leave). Can you imagine winning the lottery twice in your life?

2. I did a major remodel of my house several years ago. Contractors were getting rich by buying run-down old houses in nice neighborhoods for $600K, tearing them down, rebuilding them with $400-500K investment, and then reselling for $1.2M - $1.5M. I used a decent, honest builder for my remodelling job, and we discussed doing such a project, but from pure laziness I never followed up on it. All he needed was more capital.

3. In my past dating experiences, I met a lady in 2003 who had been working for 5 yrs at the city planning commission or city building dept (can't remember which), who was responsible for managing construction projects all over the Bay Area. She was well connected with many contractors, and was intimately familiar with Bay Area neighborhoods. We did joke that we'd make good business partners, she knew exactly what needed to be done for a successful condo conversion and the best locations for doing such a conversion, but was too young to have built up the working capital yet (I think owning a new Mercedes AMG didn't help). I passed on a 3rd date, and passed on the project when she got engaged 2 months later.

4. My co-workers and I made fun of another co-worker who flipped a million dollar mansion in less than 2 mos last year. In the Bay Area, you have to enter a lottery system to gain the right to buy a new house, and it's been this way for desirable properties since 1991. Well, this guy won the lottery, bought a house for $1.2M, then re-entered the lottery again and won again a month later, bought the second house for $1.2M, and then sold the first house 2 months later for $1.5M. All in the space of 3 months. We laughed at him, but who can't use an extra $300K in 3 months for doing no work? Winning the housing lottery was just like winning a real lottery, except the odds are more like 2:1 or 3:1 rather than 18,000,000:1.

5. I have a childhood friend whom I've known for over 30 years. We went to the same grade school, high school, and university. He built his company into one of the largest architectural firms in Silicon Valley. Definitely a guy I could have invested with on real estate projects, but in our 30+ yr friendship, we've never discussed money.